What does my credit score mean?

Posted on Aug 28, 2013

Are you thinking about applying for a loan, or wondering why your interest rate is what it is? Chances are good that your credit score is going to play a big role in both. What is your credit score? Your credit score is your ability to pay your debts and how big of a risk to a lender you would be. The higher the score, the higher your chances of getting a good loan with a lower interest rate.

Are you thinking about applying for a loan, or wondering why your interest rate is what it is? Chances are good that your credit score is going to play a big role in both. What is your credit score? Your credit score is your ability to pay your debts and how big of a risk to a lender you would be. The higher the score, the higher your chances of getting a good loan with a lower interest rate.

How is my Credit Score Calculated?

There are many factors that go into this. Roughly a third of your score is determined by your credit history and whether you pay your bills on time. Other factors that go into your credit score are how many lines of credit your have and how much of your credit you have used up. The more cards you have the better and the less credit your have used up the better.

What are Some Ways I can Check my Credit Score?

The first step to checking your credit score is to get your credit report. How do I get my credit report? You can go to one of the three credit bureaus and request a credit score. You can also go to your bank or credit union and request a copy. Each borrower gets one free copy of their credit report a year.

One thing that can affect your score is the accuracy of your credit report. There could be mistakes on my credit report that could affect my credit score, you might be asking? Yes, not all creditors report accurately on your credit report, so make sure that it is accurate by requesting a copy at least once a year to check for errors that can be holding your score down.

How Else can you Improve Your Credit Score?

Pay your bills on time and make sure that you don’t get in over your head with debt. Repossessions and bankruptcies can damage your score and make it less likely to get a loan in the future.

Your credit score is going to be the way that a lender determines whether or not to give you a loan. If you have a high score you are going to have a better shot at getting a loan for a car or a house. Make sure you are keeping up with your credit report and paying your bills on time.

By: William Hauselberg

http://www.articlecity.com/articles/business_and_finance/article_16035.shtml

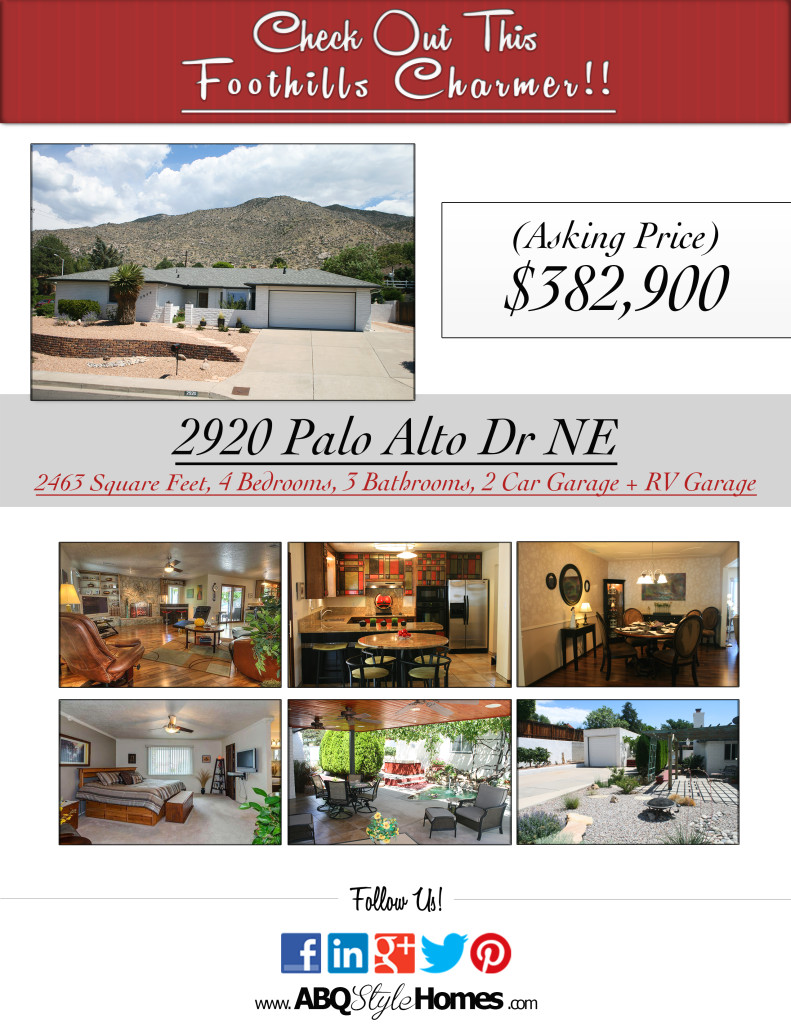

For SALE – 2920 Palo Alto Dr NE

Posted on Aug 27, 2013

Don’t miss this remodeled Foothills Custom!! Backyard Oasis + RV Garage!!

Easy-to-change seasonal decorating ideas

Posted on Aug 21, 2013

When spring arrives with its bright sunshine, fresh air, vibrant colors and light, do you find yourself regretting the decorating decisions you made last fall or winter? It’s natural to incorporate the season into your home decor, and the best way to do that is with design touches that can change as easily – and quickly – as the seasons themselves.

When spring arrives with its bright sunshine, fresh air, vibrant colors and light, do you find yourself regretting the decorating decisions you made last fall or winter? It’s natural to incorporate the season into your home decor, and the best way to do that is with design touches that can change as easily – and quickly – as the seasons themselves.

While you may love the bright reds and greens of the holiday season or the lush lilacs and blues of spring and summer, making them the foundation of a room’s design can leave the decor feeling out-of-step when the seasons change. By starting out with a foundation of neutral colors in walls, flooring and furnishings, you can add colorful and seasonally appropriate accents.

Updating your decor to complement the season is as simple as focusing on a few key areas.

Lighting

It’s easy to overlook, but lighting is a key element in room design, and one that needs to change with the season.

In spring and summer, when sunshine is abundant and the days are longer, you can rely more on natural light. During warm months, you may only need artificial light late in the evening, when the advanced hour makes soft, muted light appropriate. Winter’s shorter days and weaker sunlight lead to greater dependence on artificial light throughout the day, so your lighting design should include options that can be used throughout the day.

Most rooms will benefit from a mixture of overhead lighting, floor lamps, wall sconces and table lamps.

Walls

While neutral-hued walls make a versatile background for virtually any design, don’t be afraid to spice things up with seasonal touches. Repositionable wall covering options make it possible to create a seasonal look with a wall mural – and then remove it and replace it with something different when the season changes.

A patented adhesive allows you to easily place the removable wallpaper on virtually any smooth, flat surface, from windows to walls. You can pull it down, reposition it elsewhere, even fold it up and store it in a drawer for use next year. A wide variety of designs mean you can find something to fit your seasonal decor, and if you don’t see anything you like, you can customize by submitting your own original photo through the website.

Flooring

If your floor is wood or you have a newer home with builder-installed carpet, you probably already have a neutral palette to work with. Adding seasonal flair to floors is as simple as adding or removing area rugs.

Area rugs in rich tones can warm up a room during winter months – especially when wood floors can feel cold underfoot. You can even add an accent rug in evergreen or crimson to underscore your holiday decor.

In warm months, when your family spends more time outdoors, a more durable area rug, positioned near entryways can help keep soil, grass clippings and other debris off your carpet or floor.

Accessories

From window treatments to wall art, accessories are an easy, great way to create a seasonal look in any room.

In winter, when you want to keep out the chill, choose heavier drapes in colors that inspire warmth and comfort. For autumn or spring, when you want to welcome in sunlight, lighter, sheerer options can be appropriate. And in summer, when you’ll rely on blinds to block out hot midday sun, pastels and lighter fabrics can be a soothing foil to the utilitarian appearance of blinds.

Just as you change your own wardrobe to stay in step with the seasons, updating your home decor seasonally can help make your home feel welcoming and comfortable. Fortunately, it’s easy to keep your home decor in tune with the seasons when you make a few updates that are easy to change with the season.

Courtesy of BPT

Beautiful Custom Rutledge! SOLD!

Posted on Aug 15, 2013

SOLD in 6 days! We have successfully helped another family in selling their home. Call us today, to help with your real estate needs!

Myth and fact: What you need to know about credit scores

Posted on Aug 14, 2013

For all of the discussion around the importance of credit scores, it’s hard to know what’s true, what’s fiction, and what lies in between.

For all of the discussion around the importance of credit scores, it’s hard to know what’s true, what’s fiction, and what lies in between.

While there are misperceptions and misunderstandings still lingering in the marketplace, the good news is that overall knowledge about credit scoring is improving. A recent survey by the Consumer Federation of America (CFA) and VantageScore Solutions, one of the two primary companies that generate credit scores, shows that consumers know they have more than one credit score, have a better understanding about the factors that affect credit scores, and have increased familiarity with how different kinds of companies and entities use credit scores. Consumers also have a good handle on some recent additions to federal laws regarding when lenders are required to inform borrowers about their credit scores.

“Increases in consumer knowledge probably reflect, in part, the increased public attention given to credit scores because of the new protections,” says Stephen Brobeck, executive director, CFA. “The improvements may also be related to increased efforts of financial educators, including our own educational website, creditscorequiz.org, to inform consumers about credit reports and scores.”

However, despite the positive developments, there’s room for improvement according to the CFA-VantageScore Solutions survey.

Myth: Low credit scores don’t greatly affect how much you pay over the life of the loan.

Fact: Low scores can be costly. Only 29 percent of survey respondents were aware that on a $20,000, 60-month auto loan, a borrower with a low credit score is likely to pay at least $5,000 more than a borrower with a high credit score.

Myth: Age and marital status are factors used in calculating credit scores.

Fact: Over 50 percent of survey respondents incorrectly believed their age and marital status were factors used to calculate their credit scores. The only factors credit score models use are related to your use of credit, especially whether you make payments on time.

Myth: Multiple inquiries when applying for a consumer or mortgage loan will have a negative effect on your score.

Fact: If multiple inquiries occur during a one-to two-week window, generally they will not lower your credit scores. Only 9 percent of respondents were aware of this, and 34 percent incorrectly believed that each inquiry will lower your score.

Understanding credit scoring can be complex, but it’s in your best interest to get the facts straight. With a clear view of what’s true and false, it’s easier to set the course for a sound financial future. For more information about the myths and facts of credit, visit www.creditscorequiz.org, www.vantagescore.com and www.consumerfed.org. These websites are free, do not display any advertising and do not collect any personal data. Both the online quiz and a corresponding brochure are also available in Spanish at www.creditscorequiz.org/Espanol.

Courtesy of BPT

Follow Us!